There is a common saying in selling real estate (well, selling anything really) that goes something like this:

“Something is only worth what someone else is willing to pay for it at the time you wish to sell it.”

There is a lot of truth to that, but of course MANY factors will ultimately drive what that price will be that someone else is willing to pay. In this multi-part blog series, we’ll cover some of the largest drivers of ag land values. We’ll also provide some context to our local Southern Red River Valley land market and how it relates to these factors. Let’s continue!

Read Part 1: Soils

Part 2: Drainage

Another heavy-weight when it comes to factors impacting the value of farm land is how well or poorly a piece of land drains. Good drainage on farm land has huge benefits. Well drained soils a) can generally be worked and planted earlier in the spring, b) have higher seed germination, c) grow plants with a stronger root system which leads to better access to subsoil moisture and nutrients, and d) generally produce higher yields.

Another heavy-weight when it comes to factors impacting the value of farm land is how well or poorly a piece of land drains. Good drainage on farm land has huge benefits. Well drained soils a) can generally be worked and planted earlier in the spring, b) have higher seed germination, c) grow plants with a stronger root system which leads to better access to subsoil moisture and nutrients, and d) generally produce higher yields.

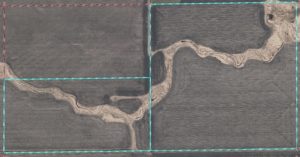

You may have the best soils around, but if the water backs up on your land or stays on the land too long, it will have a big impact on the value of it. If a piece of land has a lot of wetlands on it and/or is prone to flooding or drown out areas, this means the yield potential for the land will be diminished. Generally, the lower the yield potential the lower the value.

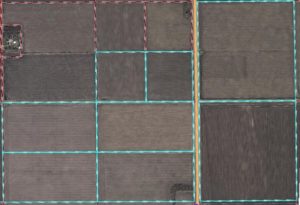

While most of the land in the Red River Valley is generally described as “flat, black, and square,” that doesn’t mean water drains the same across the entire valley. Many pieces of ag land in our area have some natural drainage features or impediments, such as natural undulation, elevations, roll or slope (however subtle they might be), small coulees, natural drains, and more. These natural features usually have either a positive or negative effect on drainage within a given piece of farm land. A great way to see the elevations and contours of land is through LiDAR images which show high and low points really well (example to the right). Contact us if you want a LiDAR image of your land. You can also contact your local FSA office (ND or MN) and ask for a wetland map of your land which would show likely problem areas.

While most of the land in the Red River Valley is generally described as “flat, black, and square,” that doesn’t mean water drains the same across the entire valley. Many pieces of ag land in our area have some natural drainage features or impediments, such as natural undulation, elevations, roll or slope (however subtle they might be), small coulees, natural drains, and more. These natural features usually have either a positive or negative effect on drainage within a given piece of farm land. A great way to see the elevations and contours of land is through LiDAR images which show high and low points really well (example to the right). Contact us if you want a LiDAR image of your land. You can also contact your local FSA office (ND or MN) and ask for a wetland map of your land which would show likely problem areas.

Then there are man-made changes to drainage, all meant to improve drainage for the land. Two common in this area are surface ditching and drain tiling. Drain tile in this area is becoming more and more common as a way to improve drainage of land that otherwise may hold water longer than desired, or even to help reduce issues such as salinity in the soil. While drain tiling can come at a hefty expense (many ballpark the cost at around $1k/acre +/-), the benefits can also be significant.

Keep in mind, not ALL land is a good candidate for drain tiling. Depending on the soil types or other issues such as soil sodicity, you may not get the full benefits tiling can bring. Here is a good article put out by the NDSU Extension Service that may help you decide if your land is a good candidate or not.

If you farm your land, you already know if you have good drainage or not. If you do not farm it or perhaps live out of state and aren’t sure, you may be curious to know how good your drainage is. The easiest way to find out is to call your renter and ask for their feedback! If you want another opinion, you are always welcome to contact us as well and we would be happy to do some research for you.

Remember, drainage is just one of many factors that impact the value of farm land. Stay tuned for future articles in this blog series that will uncover more.

Until next time!

Andy

Part 1: Soils

Part 3: Size & Shape

Part 4: Status of the Market