When it comes to owning land, many people tend to think about ownership in the singular form…one piece of land has one owner. However, it is quite common that a single piece of land has 2 or more owners. It might be a husband and wife, related or unrelated business partners, or quite commonly heirs of land that was passed down from a previous generation. There are two primary ways the legal title to property is held when 2 or more owners are involved: Tenants in Common and Joint Tenancy. In this post, we’ll cover what we see as the most common type with land owners generally: Tenants in Common.

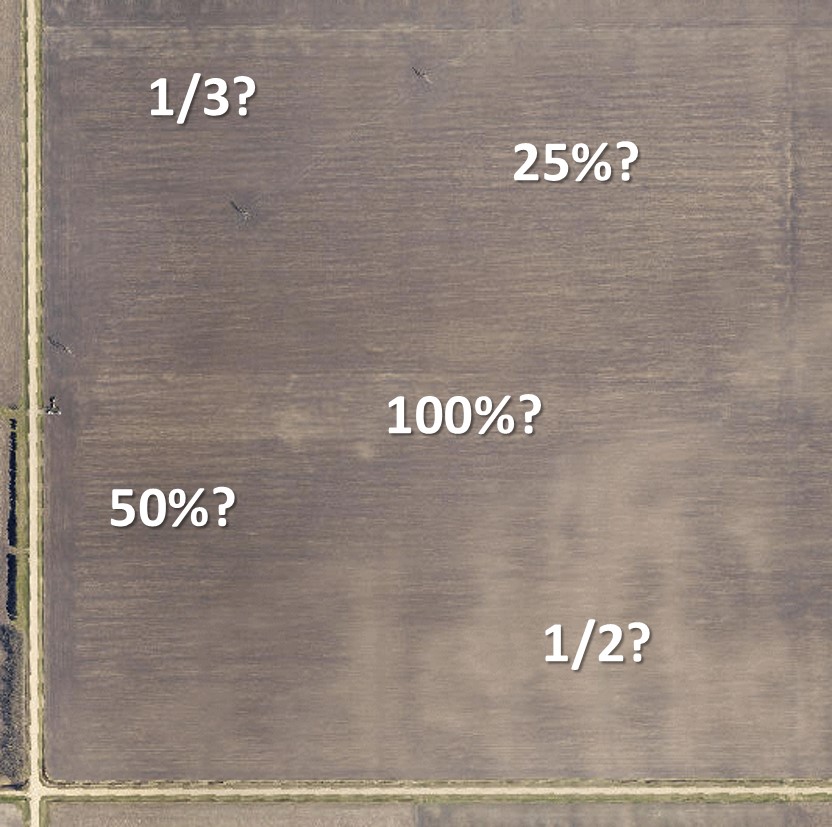

The main thing to know about being Tenants in Common is that each owner has what is called an “undivided interest” in the parcel. Having an undivided interest means that no one owner has a specific piece of the land, but rather a share (or “interest”) in the entire property. So for example, if two people equally own 160 acres as Tenants in Common, each would have a 50% undivided interest in the entire 160 acres. They do not each own a specific 80 acres with set boundaries.

We see this method of ownership quite frequently in the Red River Valley of North Dakota and Minnesota (it’s common in many other places too), and usually it is because of 2 primary reasons:

- Partners came together to buy a piece of land to operate it or for an investment, or more frequently

- The land was divided and passed down to multiple heirs through an estate or trust

Owning land with other parties can work very well and there are many reasons why. However, there are times when being Tenants in Common with other owners can have its downsides too. Consider the following two scenarios:

- Three siblings own two quarters of land together as Tenants in Common. One of them farms the land, then pays a pro-rata share of rent to the other two siblings. The land is good but would be much improved with drain tiling, which typically comes at a cost of around $1,000 per acre. The sibling farming the land is pushing to get the land drain tiled at a cost of over $300,000 (or $100,000 to each owner). The other siblings do not want to put that much cash into land they don’t entirely own.

- Four cousins inherit a quarter of land when their uncle passes away. Shortly after the funeral, one of the cousins finds himself in financial trouble and wants to sell the land to pay off some debts. Meanwhile, the other 3 cousins are content to receive the rent income and have no desire at all to sell.

You can see the potential trouble ahead in each of those scenarios. Thankfully there are options for owners to consider when it comes to the sale of land owned as Tenants in Common with undivided interests. They include…

- There is nothing to stop a Tenant in Common from selling their undivided interest to someone else. They can sell it to one of the co-owners of the same land, or to a completely different buyer unrelated to the current ownership group. There are some buyers out there who are open to buying undivided interests, but the downside here is that not ALL buyers are open to that arrangement. Many buyers of land often want to have sole title to the property, usually to avoid the types of issues described in the scenarios above. When you reduce your potential buyer pool, you also reduce your chances of achieving the highest sale price for your land.

- Another method is to “partition” the land through some legal agreements & documents whereby the undivided interests become DIVIDED interests into individual sole title owners. In this case, each owner receives a share of their deeded land with specific boundaries . For example, if two partners own 320 acres as Tenants in Common, they could have a Partition Agreement and Quit Claim Deeds drawn up to split off 160 acres to one party and the remaining 160 acres to another party. This process can be very clean or it can be very messy. It all depends on the willingness of the partners to divide the land along with how easily the land can be divided so that all partners receive their equitable share.

- If owners cannot agree on how to partition the land, then the courts can step in and help get the land partitioned. Not ideal of course, but it is an option. Seek good legal advice if you are in this situation. This is usually called a “suit to partition” or “partition action” in the legal system.

- In terms of the act of actually splitting up ownership of the land, this might be easy and it might be incredibly difficult. For example, splitting a quarter of land with consistent soils, drainage, and tillable acres across it would be quite simple. Each owner could feel good knowing the value of the land they received is an equitable share based on the percentage they owned under the Tenants in Common scenario. However, splitting a quarter of land that contained a mix of wetlands, pot holes, waste acres, varying soils of high and low quality, etc. could prove VERY difficult to divide. Some owners may receive higher value land and others may receive lower value land, so perhaps the acres aren’t split cleanly across the interests in the partnership. Appraisers, realtors and auctioneers can be good sources of help with how to equitably split a piece of land with varying qualities (feel free to Contact Us if you would like!).

If you find yourself in a tough position as Tenants in Common, take heart as we have seen these situations can be resolved successfully. The road may be bumpy at times but there are many who have gotten through it just fine and you can too! And remember that as Realtors and Auctioneers, we are not Lawyers or Accountants so make sure you consult yours to get into the details.

Until next time!

Andy