If you have ever bought and sold land or commercial real estate before, you likely have heard of (or maybe even executed) a 1031 exchange. I have found many clients know a thing or two about them, while others are experts having done numerous 1031’s in the past. However, many clients I work with are unfamiliar with the rules or entirely new to the concept. So let’s dive into the topic of 1031’s and arm you with more information on this incredibly powerful tax-saving, wealth-building tool!

PS: Remember, we aren’t lawyers and we aren’t accountants…so ALWAYS consult with them to make sure you follow all the right rules and regulations!

What is a 1031?

In its simplest form, a 1031 Exchange is the process provided for by the IRS to defer capital gains taxes from the sale of one property by using the funds from that sale to buy another “like-kind” property. For example, if you are selling a $1M property and you have capital gains of $500k, rather than paying taxes on that gain (which could easily be 25% or more), you can purchase a replacement property with those funds and defer your capital gain (i.e. no tax is due after your sale). Pretty powerful stuff!

It is called a 1031 Exchange because it is defined in Section 1031 of the IRS tax code. The IRS has had a process for deferring capital gains on property dating all the way back to 1921 actually, and over the years it has taken on different rules and changes to become a VERY common process among real estate owners and investors. There are a number of rules you must follow around the type of replacement property you can buy (“like-kind”) and when you must finish the process in order to qualify. Let’s cover the big ones rules…

Note: If you plan to do a 1031 when selling a property, just tell your Realtor and/or closing company that you intend to do one. They will help guide you from there and make sure that a “Qualified Intermediary” is ready to handle the process and paperwork for you. There are even multiple types of 1031 exchanges and some other things to note…here is a good resource with more details direct from the IRS.

What does “like-kind” mean?

To qualify for a 1031 Exchange, the IRS says you must purchase a “like-kind” property (which becomes your replacement property) to replace the one you sold (which is called the relinquished property). Thankfully the definition of “like-kind” is quite broad. If you own real estate for your business, trade or for investment, you can purchase any type of real estate that meets that criteria. So if you are selling farm land, you can buy more farm land OR you can buy an apartment building, warehouse, or piece of development land. All would be considered investment property, and therefore “like-kind” to what you sold. One important thing to note here is you cannot buy replacement properties outside of the United States to qualify for a 1031 Exchange.

What are the time limits to do a 1031 Exchange?

There are two big dates to know about when doing a 1031 Exchange. The first is the identification period. From the date of closing on your relinquished property, you have 45 days to identify one or more replacement properties. This is a HARD date, meaning if 45 days go by and you have not yet identified replacement properties, you WILL pay the tax on the gain of your relinquished property. There are numerous methods for identifying the replacement property, but the most common is the “rule of 3” where you list up to 3 properties that you may purchase (you don’t have to buy them all, but you can if you have enough funds).

one or more replacement properties. This is a HARD date, meaning if 45 days go by and you have not yet identified replacement properties, you WILL pay the tax on the gain of your relinquished property. There are numerous methods for identifying the replacement property, but the most common is the “rule of 3” where you list up to 3 properties that you may purchase (you don’t have to buy them all, but you can if you have enough funds).

The second important date to know is that from the date you sold your relinquished property, you have 180 days to actually purchase and close on the replacement property (or properties). Here again, if you get to the 181st day and haven’t closed, then you will be paying that tax bill.

How long is the tax deferred?

That depends. If you sell your replacement property and do NOT do another 1031 Exchange, then the capital gains due on your original relinquished property AND your recently sold replacement property will be due. The great thing about 1031’s however is that you can keep doing them over and over! So if you sell your replacement property, you can do another 1031 Exchange to buy a new replacement property. Some clients even plan to use the “defer, defer, die” strategy…which sounds a bit morbid but it essentially means if you keep deferring capital gains through 1031’s until you die, when your property is passed to your heirs they will receive a stepped-up basis in the property (up to a limit) and the tax obligation goes away! Again, always consult your accountant and/or lawyer with matters such as this.

Why do I need a “Qualified Intermediary” to do a 1031 Exchange?

One last important rule to point out is that to do a 1031 Exchange, you MUST use a Qualified Intermediary (“QI” for short). This is a neutral third-party that acts on your behalf to accept and hold the funds from the sale of your relinquished property, and then they use those funds to help you purchase the replacement property. It is critical you never directly receive the funds from the sale of your relinquished property. They must go directly to the QI. They will handle the funds and the paperwork to make sure you follow the rules and properly defer your taxes per the Section 1031 code. Most title/closing companies can serve as a QI, but if you ever need a list of organizations that can help just let us know.

What is a 1033 Exchange?

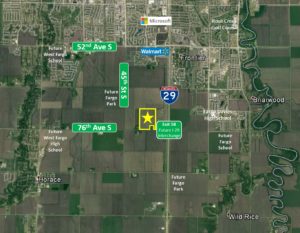

Normally I wouldn’t bother explaining a 1033, but here in the Southern Red River Valley (specifically Cass County, ND), we have had numerous clients qualify under the rules of the 1033 Exchange. This is the IRS Code for an “involuntary conversion”…i.e. a forced sale such as the land acquisitions being done for the Fargo-Moorhead Diversion. The 1033 functions in much the same way in that it helps sellers defer capital gains, however the time limits are MUCH longer and more flexible than on the 1031 Exchange rules. For example, under a 1033 Exchange the seller has up to 2 years to find and acquire their replacement property. They can also accept the funds from their sale instead of holding them with a QI as required by a 1031.

Here in the southern Red River Valley we have helped dozens of clients perform 1031 transactions, saving hundreds of thousands of dollars in taxes for them. They are a fantastic tool for accumulating and preserving wealth. If you are thinking about selling Red River Valley farm land and want to explore your 1031 or 1033 Exchange options, please contact us and we would be happy to show you how we have helped other people do the same thing!

Until next time,

Andy